Using Blockchain in Banking in 2026

Introduction

Blockchain technology is transforming the banking sector at a rapid pace, delivering new levels of security, efficiency, and transparency.

According to Deloitte’s Global Blockchain Survey, 39 % of surveyed organizations had already moved blockchain solutions into production, up from 23 % in the previous 2025 year, showing growing real-world deployment of distributed ledger technologies in financial services.

Also, market research from Juniper Research found that blockchain deployments could enable banks to realize more than $27 billion in cost savings by 2030, particularly in cross-border settlement and transaction processing, helping to reduce operational costs significantly.

Blockchain technology has numerous applications in banking, including payment processing, trade finance, digital identity management, and fraud prevention. By decentralizing data storage and automating processes through smart contracts, banks can reduce errors, enhance transparency, and strengthen security across their operations.

This article was prepared by experts at ilink, based on reliable industry sources and the practical experience of the company’s team of analysts and developers. The insights presented reflect real-world blockchain implementations in the financial sector and current trends shaping the future of banking technology.

How Can Blockchain Be Used in Banks?

1. Settlement systems.

One of the primary applications of blockchain in banking is enhancing settlement systems. Traditional banking relies on intermediaries, which can be slow and costly. However, blockchain-based financial services offer real-time settlement, reducing bank transaction times and operational costs.

2. Cross-border payments.

Cross-border payments are set to explode by 2025, with projections indicating a leap from $190.1 trillion in 2023 to $290.2 trillion by 2030. Blockchain payment systems facilitate these transactions by providing a faster and more affordable alternative to traditional methods. The decentralized nature of blockchain is changing banks, allowing them to bypass intermediaries and reduce cross-border payment processing fees.

3. Fraud prevention and security.

One of the biggest challenges banks face is fraud. Blockchain for secure transactions provides an immutable ledger, making it difficult for malicious actors to manipulate or falsify data. Blockchain-enabled transparency ensures that all transactions are recorded and traceable, reducing the risk of fraud and enhancing security.

4. Loans and credits.

Blockchain is also transforming loans and credit services. Smart contracts in banking allow the automatic execution of loan agreements based on predefined conditions. This automation reduces paperwork and minimizes the risk of default, as the terms are enforced without human intervention.

5. Customer KYC.

Know Your Customer (KYC) processes are crucial in banking but are often time-consuming and costly. Blockchain for digital identities in banking allows banks to store customer information in a secure, decentralized database, streamlining the KYC process. With blockchain technology in banking, customer data is more secure and easily verifiable, ensuring compliance with regulations.

6. Smart contracts.

Smart contracts play a pivotal role in blockchain-based financial services. They facilitate agreements and transactions without intermediaries, reducing delays and improving efficiency. Smart contracts in banking allow for more transparent and reliable transactions, leading to greater trust between banks and their clients.

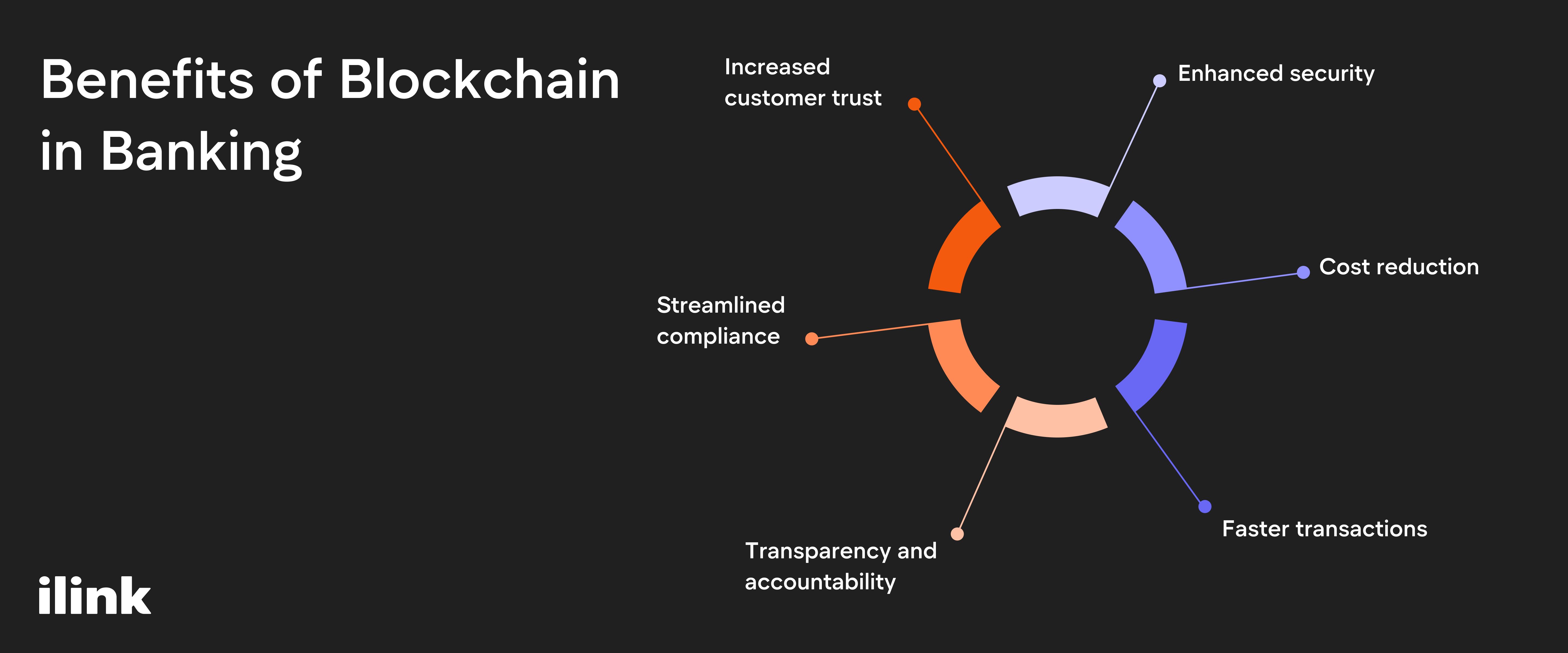

Benefits of Blockchain in Banking

The application of blockchain in banking offers numerous specific advantages that are shaping the future of financial institutions:

- Enhanced security. With blockchain for secure transactions, every data block is cryptographically secured and linked to the previous one, creating an immutable chain. This significantly reduces the risk of data tampering, fraud, and hacking, providing banks with a more secure infrastructure.

- Cost reduction. By eliminating the need for intermediaries (such as clearinghouses and central authorities) and reducing manual processes, banks using blockchain can cut down operational and transaction costs. For example, processing fees for international payments can be lowered due to the decentralized nature of blockchain technology in banking.

- Faster transactions. Traditional banking settlements can take days, especially for cross-border payments. Blockchain in banking enables real-time transactions to be settled, improving liquidity and providing more rapid and efficient customer service.

- Transparency and accountability. The decentralized ledger of distributed ledger technology (DLT) in banking offers transparency as all transactions are visible to authorized parties. This enhances trust, ensures accountability, and reduces the need for audits and reconciliations.

- Streamlined compliance. With blockchain for digital identities in banking, regulatory compliance processes such as Know Your Customer (KYC) and Anti-Money Laundering (AML) become more efficient. Customer data is stored securely on a blockchain, allowing banks to quickly verify identities without repeatedly collecting the same information.

- Increased customer trust. By utilizing blockchain-enabled transparency, banks can offer clients greater visibility into their transactions, enhancing customer trust and loyalty.

Ready to improve your banking systems with blockchain?

Request an expert consultation.

Challenges and Risks of Implementing Blockchain in Banking

Despite its many benefits, blockchain in banking faces some challenges:

- Regulatory compliance. Governments and regulators are still figuring out how to govern blockchain-enabled transparency and other aspects of this technology.

- Integration with legacy systems. Many banks have complex legacy systems that require more support to integrate with blockchain solutions for banking efficiency.

- Scalability. While private blockchain in banking offers advantages, scalability remains a concern for widespread adoption.

What Is the Structure of Blockchain in the Banking Sector?

The structure of blockchain in banking is built on the foundation of a decentralized digital ledger system, but its application within the banking industry has some unique features:

- Nodes and consensus mechanisms. In the context of blockchain in banking, a network of nodes (computers) maintains the ledger. Each full node contains a copy of the blockchain, and transactions are validated through consensus mechanisms, such as Proof of Stake (PoS) or Practical Byzantine Fault Tolerance (PBFT). This decentralized validation ensures security and transparency without needing a central authority.

- Smart contracts. Smart contracts in banking automate various agreements and transactions. These contracts are self-executing when certain predefined conditions are met, reducing the need for manual intervention. This feature of blockchain technology in banking helps streamline complex processes, such as loan approvals or interbank settlements.

- Private and public blockchains. While public blockchains are open and accessible to anyone, blockchain in banking often involves private or permissioned blockchains. These are restricted to authorized parties (banks, regulators, and selected financial institutions), ensuring higher control, privacy, and compliance with regulatory standards.

- Interoperability layers. Banks using blockchain technology must integrate these systems with their legacy infrastructures. This is often achieved through interoperability layers that enable blockchain systems to communicate with traditional banking software, allowing for seamless integration and data flow between old and new systems.

- Security layers. Security is critical in the banking sector, so blockchains often incorporate additional cryptographic measures, such as encryption and multi-signature protocols. This ensures that transactions and customer data are highly secure and compliant with regulatory standards.

- Tokenization of assets. Another structural element involves tokenizing real-world assets on the blockchain, such as stocks, bonds, or even currencies. Tokenization enables a more fluid transfer of these assets, opening up new opportunities for liquidity and investment.

This multi-layered structure of blockchain in banking provides the foundations for safer, faster, and more efficient banking services, potentially reshaping the financial landscape.

Innovations in FinTech Based on Blockchain

The fusion of blockchain technology in banking and FinTech is giving rise to various groundbreaking innovations, reshaping the financial landscape, and pushing the boundaries of traditional banking services.

Decentralized finance (DeFi)

DeFi is one of the most significant innovations driven by blockchain-based financial services. It offers financial products like loans, savings, and insurance without intermediaries. By using smart contracts in banking, DeFi platforms automate these services, providing users with direct access to financial tools. DeFi platforms have been rapidly gaining popularity as they offer faster, cheaper, and more inclusive financial services than traditional banks.

Tokenization of assets

Another important innovation is the tokenization of assets. This involves converting real-world assets like stocks, bonds, or even real estate into digital tokens on a blockchain. These tokens can be traded or transferred instantly without traditional brokers. Tokenization allows for fractional ownership, meaning individuals can own parts of an asset, lowering the barriers to entry for investments. This innovation opens up new possibilities for blockchain-driven banking transformation.

Blockchain-based payment systems

Traditional payment systems, especially for cross-border payments, can be slow and expensive due to the need for intermediaries. However, blockchain payment systems enable real-time, low-cost payments across borders. Banks and FinTech startups are leveraging blockchain in banking to create more efficient global payment solutions, with leading players like Ripple and Stellar paving the way for instant cross-border transactions. This innovation is expected to contribute significantly to the growth of the global cross-border payments market, which is projected to reach $290.2 trillion by 2030.

Peer-to-peer lending and crowdfunding

Blockchain-based financial services have revolutionized peer-to-peer (P2P) lending and crowdfunding platforms. These platforms utilize distributed ledger technology (DLT) in banking to create secure, transparent environments where individuals can lend or invest directly without intermediaries. Using smart contracts in banking ensures that agreements are automatically enforced, reducing the risk for lenders and borrowers.

Digital identity and KYC solutions

Customer verification is a significant challenge for banks, with KYC processes often needing to be more efficient and prone to errors. Blockchain for digital identities in banking provides a decentralized way to verify identities securely and instantly. By storing personal data on the blockchain, customers can control their identity and share it with banks when needed, drastically reducing the time required for KYC processes. This innovation not only streamlines compliance but also improves the customer experience.

Central bank digital currencies (CBDCs)

Central banks are exploring using blockchain technology in banking to develop digital versions of national currencies, known as Central Bank Digital Currencies (CBDCs). These blockchain-based currencies aim to modernize monetary systems, enabling faster, more secure, and more efficient transactions. Countries like China, Sweden, and the Bahamas are already in the pilot stages of issuing their CBDCs, and this trend is expected to grow in the coming years.

Blockchain-based insurance

The insurance industry also benefits from blockchain-enabled transparency. By utilizing smart contracts, insurers can automate claim processing and verification, reducing the time it takes to settle claims. Blockchain-based financial services allow for more accurate risk assessment and faster payouts, improving the insurer and customer experience.

Robo-advisors and automated investment platforms

Blockchain in banking has also played a crucial role in developing robo-advisors and automated investment platforms. These platforms leverage blockchain-enabled transparency to ensure users’ funds are securely managed. Additionally, using smart contracts, these platforms can automate the rebalancing of portfolios, offering users personalized investment advice and services based on real-time data.

Conclusion

The global blockchain finance market is expected to grow significantly, reaching $80.02 billion by 2032. Blockchain technology in banking is a game changer, and as more banks adopt blockchain, we can expect further innovations and improvements in how banks operate globally.

Contact us today to discover how blockchain can transform your banking operations and bring your services into the digital future. Whether you’re looking to enhance security, streamline transactions, or explore innovative financial products, we have the expertise to guide your journey into blockchain in banking.

FAQ

What Is the Revolution of Blockchain in Banking?

The revolution of blockchain in banking lies in its ability to overhaul traditional financial systems by offering a more efficient, secure, and transparent way to handle transactions. Traditionally, banks relied on centralized systems that required intermediaries like clearinghouses to verify and settle transactions, often leading to delays and increased costs. Blockchain technology in banking eliminates these intermediaries, allowing for real-time settlement, lower transaction fees, and reduced operational complexities.

Additionally, blockchain is changing banks by enabling decentralized finance (DeFi) services, smart contracts, and digital identity management. These innovations allow banks to offer their customers more personalized and flexible financial products while maintaining high security and transparency standards.

How Does Blockchain Make Banking More Secure?

Blockchain for secure transactions uses cryptographic techniques to create an immutable record of every transaction on the network. Once a transaction is added to the blockchain, it is nearly impossible to alter or delete, reducing the risk of fraud or unauthorized changes. This is especially critical for banks, as they deal with sensitive financial data that needs to be protected from hackers and internal fraud.

Moreover, distributed ledger technology (DLT) in banking ensures that no single entity controls the entire ledger. Instead, transactions are verified by multiple nodes in the network, which must reach a consensus before any changes are made. This decentralized nature of blockchain technology in banking makes it highly resistant to cyberattacks, ensuring a more secure infrastructure for banks.

What Is Banking?

Banking refers to the financial services banks provide individuals, businesses, and governments. These services include accepting deposits, issuing loans, managing payments, and offering investment and insurance products. Traditionally, banks act as intermediaries between customers and financial markets, providing liquidity and ensuring the smooth flow of money in the economy.

With the advent of blockchain technology in banking, the role of banks is evolving. Banks increasingly integrate blockchain-based financial services to enhance security, improve efficiency, and offer more transparent products. Banks using blockchain can also provide decentralized services like peer-to-peer lending, tokenized asset management, and real-time cross-border payments, transforming traditional banking.

What Is Blockchain?

Blockchain is a decentralized digital ledger technology that records transactions across multiple computers so that the record cannot be changed retroactively. It operates without a central authority, using consensus algorithms to verify and add new data blocks to the chain. Each block contains a set of transactions that, once verified, are added to the blockchain to ensure immutability and transparency.

In the banking sector, blockchain enables more secure and transparent transactions. Blockchain for secure transactions reduces fraud risks, while blockchain-enabled transparency ensures that all participants access the same, tamper-proof information. This combination of security and openness is why blockchain is a key technology for the future of finance and banking.

Updated December 18, 2025.

Transform your financial infrastructure with blockchain.

Request a custom quote.

Comments (0)

Latest Posts

Explore how AI in fintech operations cuts costs and improves revenue beyond chatbots, with high-ROI use cases, KPI frameworks, and practical implementation guidance.

Stablecoin payments for business: where they actually save time and money, which use cases work best, what costs are overstated, and how to implement safely.

Improve operational efficiency with blockchain technology

Get your tailored development plan.