Payments Software Development

We build and integrate secure payment systems that help businesses launch faster and operate at scale. From custom payment software to ready-made crypto processing, neobank platforms, and payment modules, our solutions are designed for reliability, compliance, and rapid market entry. Request a payment solution.

Payment System Development Services

Build a future-ready payment ecosystem with a fintech partner that delivers both custom development and ready-to-launch solutions. ilink helps businesses launch secure, compliant, and scalable payment platforms faster, with lower risk and predictable costs.

01

Payment Processing Solutions

High-performance payment engines designed for real-time transactions and high load. We build systems that ensure stable processing, fraud protection, and seamless integration with banks, crypto providers, and payment networks.

02

Custom Payment Systems Development

End-to-end development of online payment platforms tailored to your business model. From architecture to deployment, we design systems that support multiple payment methods, compliance requirements, and future growth.

03

Payment Gateway Development & Integration

Secure payment gateways supporting cards, bank transfers, and crypto payments. We ensure smooth checkout experiences, fast authorization, and secure transaction handling across web and mobile channels.

04

Multicurrency & Cross-Border Payments

Payment solutions built for global operations. Support multiple currencies, automated conversion, and international settlements without relying on complex legacy banking infrastructure.

05

Digital & Crypto Wallet Development

We develop custodial and non-custodial wallets for fiat and cryptocurrencies. Wallets integrate seamlessly with payment systems, exchanges, and crypto processing modules.

06

Ready-Made & White Label Payment Solutions

Launch faster with proven, ready-to-integrate platforms. ilink provides white label payment systems, including crypto processing, neobank modules, wallets, and payment gateways that can be branded and deployed in weeks.

Custom Payment Software Tailored to Your Business

Custom Payment Software Tailored to Your Business

Payment Processing Security

We implement enterprise-grade security protocols to protect transactions, customer data, and payment flows. Our solutions are built to meet modern compliance and security standards, ensuring stable and trusted payment operations.

Fraud Protection & Risk Control

Our fraud prevention systems use intelligent monitoring and rule-based controls to detect suspicious activity in real time. This helps businesses minimize chargebacks, prevent financial losses, and protect customer trust.

Custom Payment Applications

We build custom payment applications that integrate seamlessly with your existing systems, banking APIs, and payment providers. Each solution is tailored to your business model, user flows, and growth plans.

Explore Ready-to-Launch Payment Solutions

Book a Payment Systems Consultation

Why Choose ilink Company for Development?

60 +

Qualified Employees and Developers With Us

14

Years of Experience in The IT & Payment Systems

100 +

Satisfied Clients We Have Served Globally

100

Payment Systems Developed

Continuous Technical Support

Senior fintech and Web3 engineers who keep your product stable, fast, and scalable.

Secure, Scalable Fintech Solutions

PCI DSS and KYC/AML-ready systems built for high loads and long-term growth.

Clear Timelines, Cost Visibility

Transparent estimates, clear milestones, and predictable delivery.

Ready-Made Fintech Products

White-label neobanks, wallets, and payments to launch under your brand faster.

Cost of Payments Solutions Development

Payment solutions costs from $20,000, depending on transaction load, currencies, crypto payments, AML/KYC, and fraud detection. The more payment rails and jurisdictions you support, the higher the cost. Get a detailed customized cost and timeline estimation based on your technical requirements.

See How Fast You Can Launch Your Payment System.

Request Fintech Demo.

Technologies We Use

Our IT specialists will ensure trouble-free development of payment systems using modern technologies and deep knowledge of the programming languages.

Get the best result from experienced software developers.

Backend

Mobile and Application Development

Blockchain Platform

Frontend

DevOps

QA and Testing

UI/UX Design

Case Studies

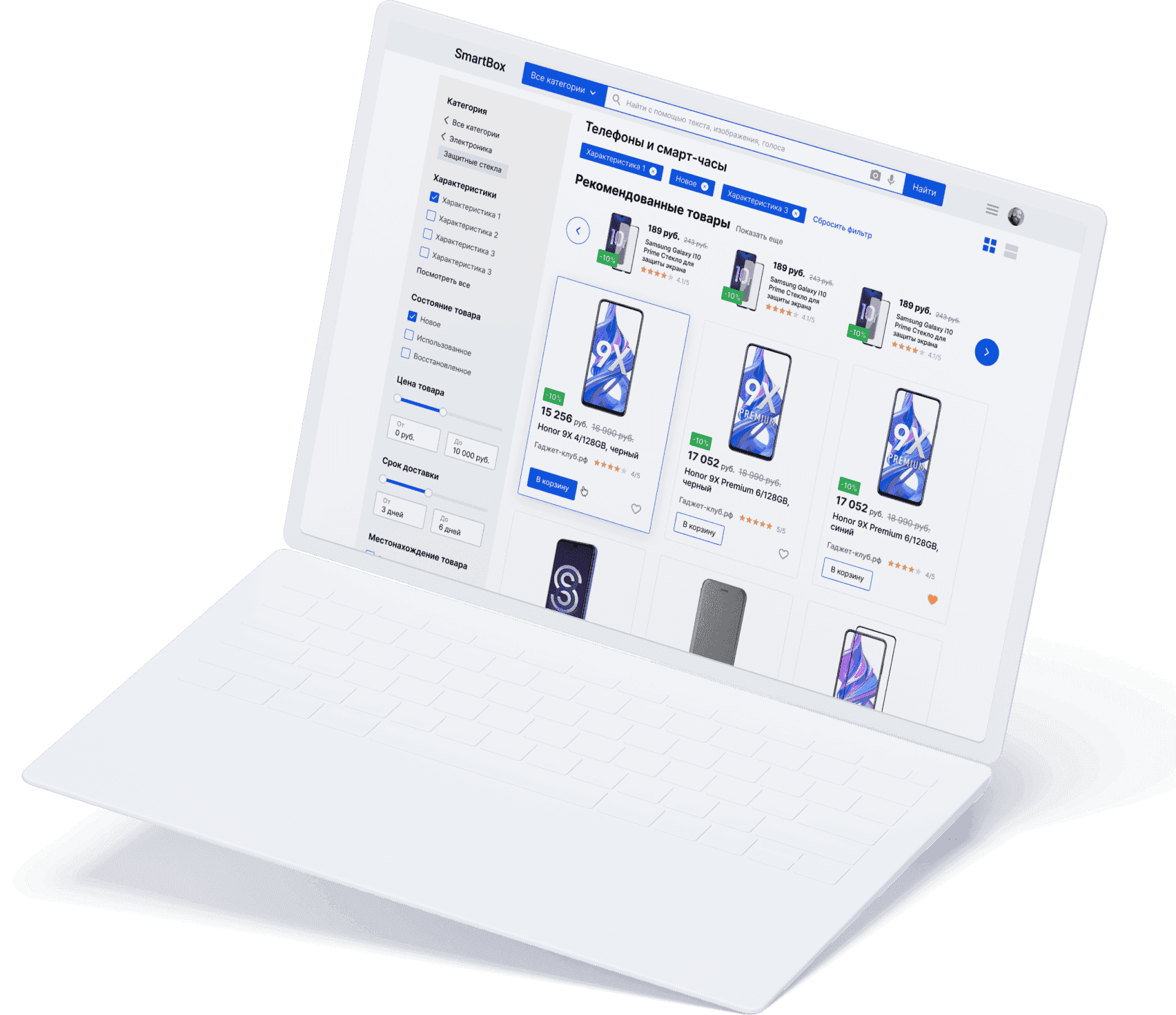

Smartbox

Smartbox is an AI-powered online marketplace that personalizes product search and recommendations for each user. Using an ML semantic matching model and a custom e-commerce engine, the platform connects buyers, sellers, and SuperApp services through secure crypto payments and intelligent product discovery.

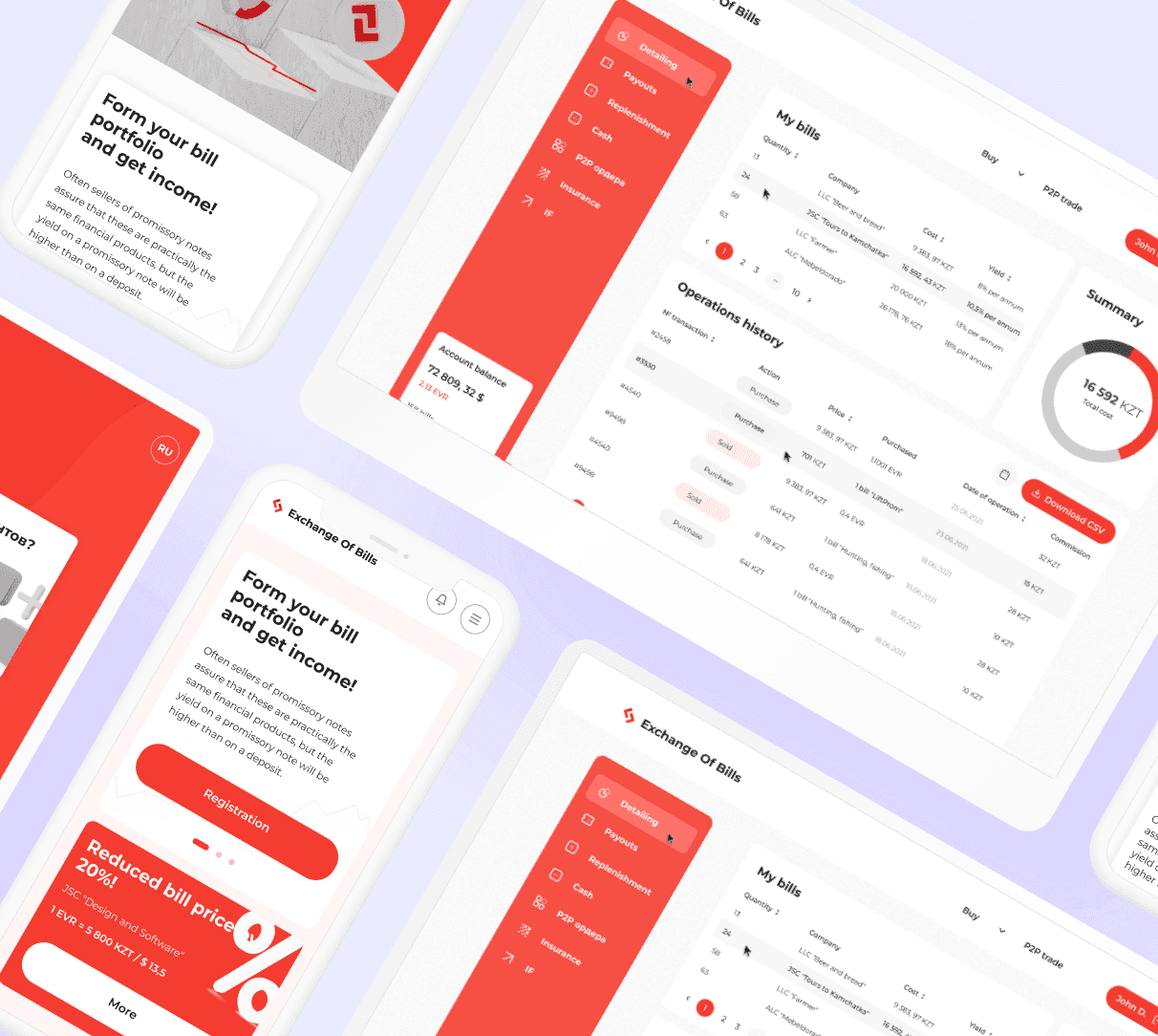

EVR

EVR is a web-based investment platform that enables companies to raise capital through tokenized electronic bills. The solution includes an investor personal account, P2P exchange for trading digital bills, fiat-to-token conversion, and ERC-20/721 smart contracts. The platform enabled businesses to attract funding through secure digital assets, while investors were able to purchase them directly and track their returns in real time.

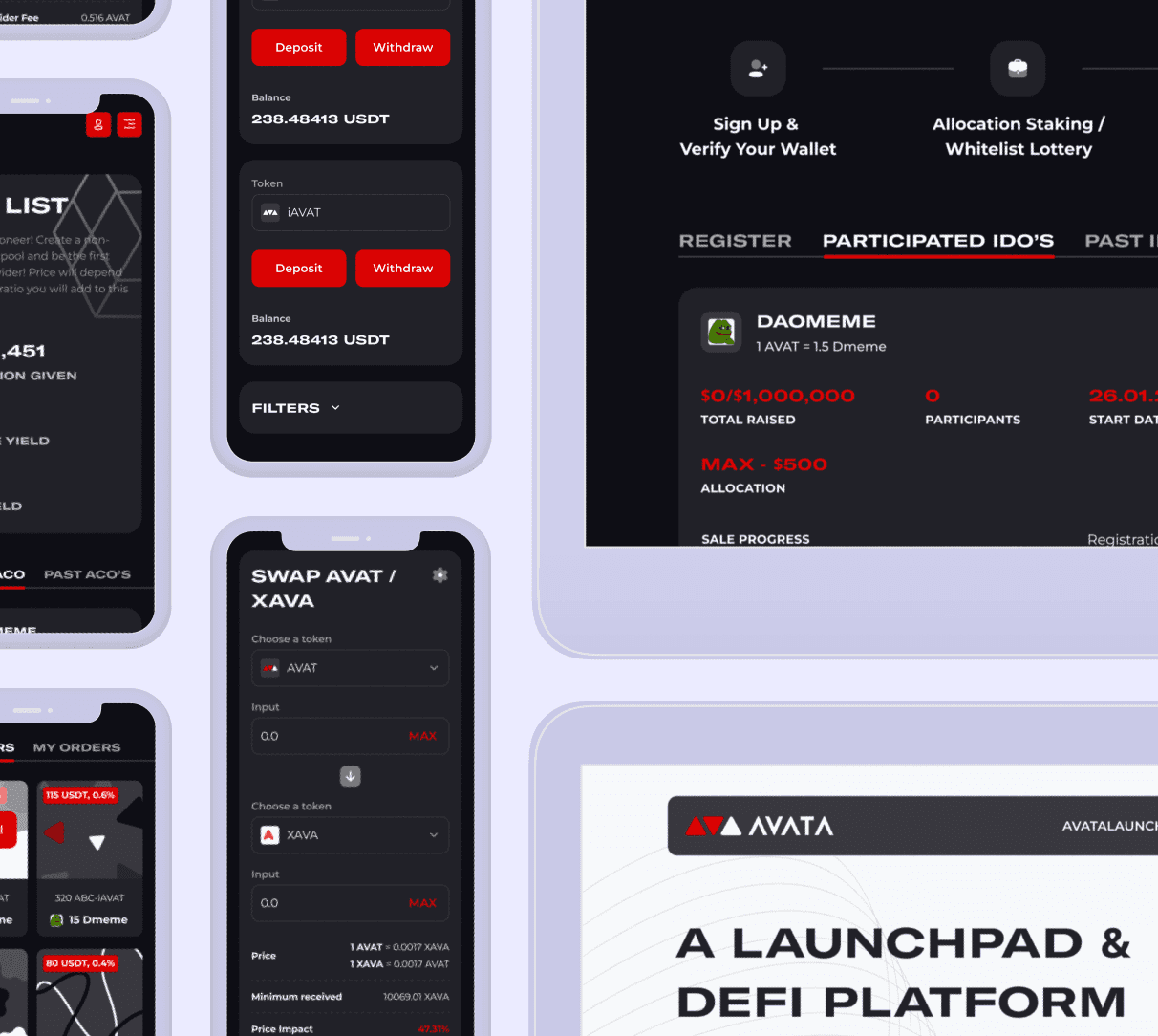

AVATA

AVATA is a decentralized launch and liquidity platform built on the Avalanche network. We designed and developed the full ecosystem, from token IDO to staking, lending, and liquidity pools. The platform was launched successfully, and the AVAT token passed its IDO stage with scalable smart contract infrastructure ready for further growth.

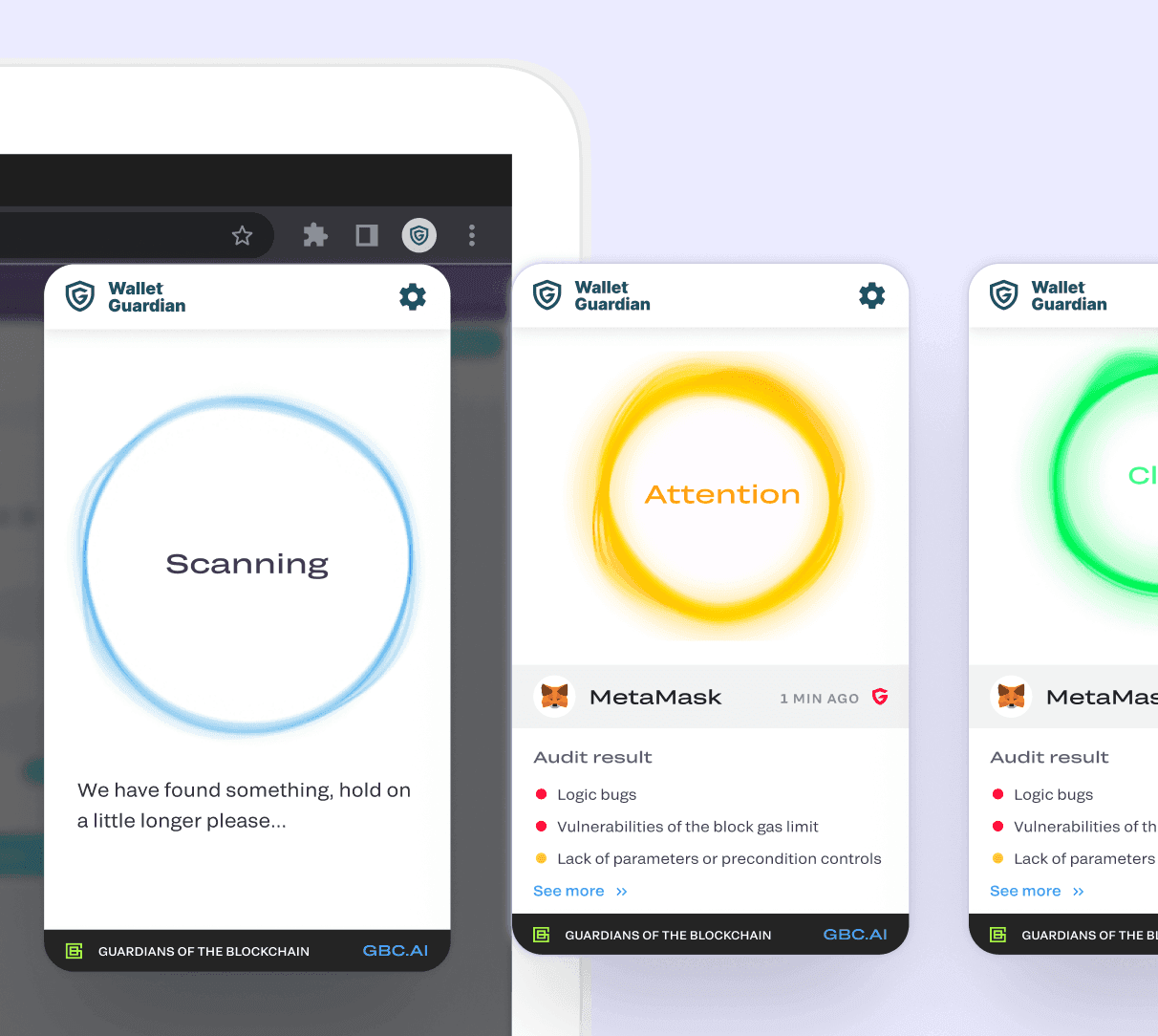

Wallet Guardian

Wallet Guardian is a Chrome browser extension powered by AI that scores token contracts in Ethereum and BSC networks. Designed to protect everyday users from scams, the system analyzes smart contracts, domain risks, exchange listings, liquidity metrics, and historical token activity to identify fraud before a transaction is executed. The product has helped users avoid millions in losses and is actively integrated into third-party systems via API.

Industry Experience of Developers

Fintech

We build secure fintech platforms, digital banks, e-wallets, and payment solutions trusted by companies in 10+ countries.

Banking

Development of high-security banking systems with strict compliance (PCI DSS, KYC/AML) and reliable transaction processing.

Payment

Cross-border payment solutions with instant settlement, crypto integration, and low-fee transaction pipelines.

Retail and eCommerce

We create platforms that enhance supply-chain transparency, product verification, and seamless omnichannel transactions.

Lending

Development of lending platforms with automated scoring, smart contracts, and secure loan lifecycle management.

Social Networking

Apps with enhanced privacy, decentralized identity, and new monetization models for user-controlled interactions.

Travel & Hospitality

Booking, loyalty, and payment apps designed for global scale, secure transactions, and seamless user experiences.

Logistic & Distribution

Solutions with real-time tracking, data transparency, and automated workflow orchestration across the supply chain.

Edtech

Secure credential verification platforms, LMS systems, and AI-powered learning applications.

Media & Entertainment

We build platforms for copyright protection, content monetization, and fair compensation for creators.

Startups

From MVP to scalable platforms we help startups launch faster, reduce development costs, and attract investors.

Feedback from Our Clients

Latest Posts

August 23, 2023

How Implementing Cryptocurrency Payments Will Help Your BusinessThe use of cryptocurrencies by companies is not only a strong publicity stunt, there are also a number of practical advantages. Many businesses around the world accept cryptocurrencies as payment for their goods or services.

December 25, 2024

Exploring the Evolution of Mobile Payment Systems Within Apps and Their Future DirectionsFrom the first rudimentary SMS-based payment options to today's sophisticated apps integrating near-field communication (NFC) and blockchain, these systems have reshaped consumer transactions.

May 14, 2025

From Compliance to Cross-Border Payments: Why Banks Are Turning to BlockchainBlockchain technology is emerging as a powerful solution, enabling banks to streamline compliance processes and transform cross-border payments.

May 13, 2025

Smart Contract Payments: Automating Payouts, Royalties, and Escrow with BlockchainAutomate payouts, royalties, and escrow with smart contract payments. Learn benefits, risks, and best practices, plus how ilink builds secure payment automation.

May 14, 2025

Stablecoins and Crypto Payments: The Future of Business Transactions?Enter stablecoins—digital assets pegged to fiat currencies, combining the benefits of blockchain with the stability businesses need.

Get Pricing and Timeline for Payment Software

Request a Consultation.