Using Blockchain in Finance

Finance Landscape

In the rapidly evolving finance landscape, blockchain technology is emerging as a powerful force of change. Originally developed as the underlying technology for cryptocurrencies like Bitcoin, blockchain is now being harnessed across the blockchain finance industry to enhance security, transparency, and efficiency. As financial institutions and fintech companies explore new ways to apply this technology, the global blockchain finance market is poised for significant growth, with projections estimating it will soar from $8.1 billion in 2023 to over $80 billion by 2032. In this article, we will look at the application of blockchain in finance and explore its benefits, use cases, and future potential in transforming financial services.

What is Blockchain in Fintech?

Blockchain, often associated with cryptocurrencies, is a transformative technology that is making waves in financial technology (fintech). It is a distributed ledger technology that allows for secure, transparent, and tamper-proof recording of transactions. In the blockchain finance industry, this technology is being leveraged to revolutionize everything from payment processing to trading and insurance.

Benefits of Blockchain in Finance

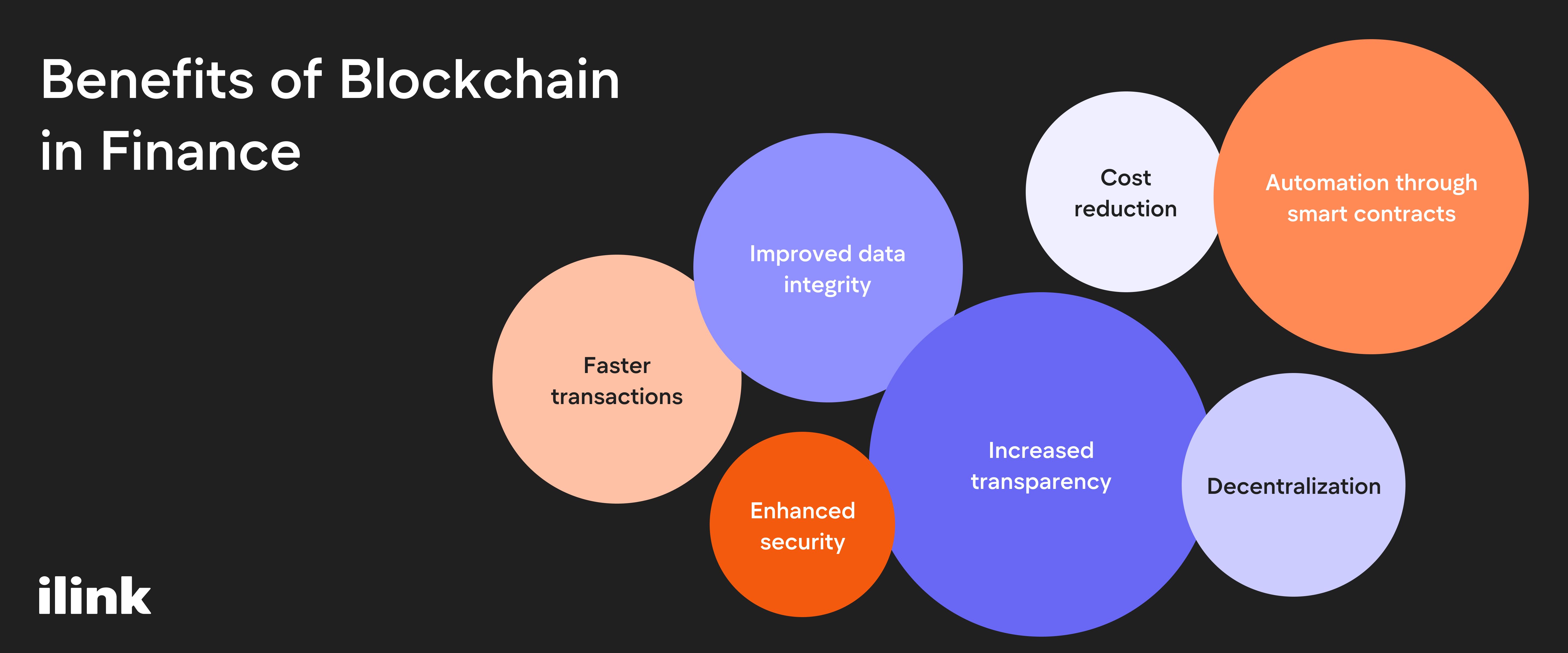

The application of blockchain in finance brings numerous benefits.

The application of blockchain in finance brings numerous benefits.

- Enhanced security. Blockchain ensures secure financial transactions with its cryptographic protocols, reducing the risk of fraud.

- Increased transparency. The distributed ledger technology offers a transparent and immutable record of transactions accessible to all authorized parties.

- Cost reduction. By eliminating the need for intermediaries, blockchain significantly cuts transaction costs and streamlines processes.

- Faster transactions. Blockchain allows for quicker processing times, especially in cross-border payments.

- Improved data integrity. Blockchain's tamper-proof records ensure financial data integrity and reduce errors.

- Decentralization. Enables decentralized finance (DeFi), giving users more control over their financial activities without relying on traditional banking systems.

- Automation through smart contracts. Smart contracts in banking automate and enforce agreements, making financial operations more efficient and reliable.

If you’re ready to use blockchain technology in your financial process, now is the time to act. Contact us today to explore how blockchain can enhance your transactions, improve security, and unlock new opportunities in the ever-evolving financial landscape.

How Blockchain is Changing Finance

Blockchain technology is not just a buzzword in the financial industry — it's a catalyst for profound change. Blockchain is redefining how financial services operate by introducing decentralized systems, automating processes, and enhancing security.

- Decentralized finance (DeFi). Blockchain is enabling the rise of DeFi, allowing users to perform financial transactions—such as lending, borrowing, and trading—without the need for traditional banks, reducing dependency on centralized institutions.

- Smart contracts for automation. Blockchain’s smart contracts in banking automate processes like loan agreements and asset transfers, ensuring they are executed only when specific conditions are met, reducing the risk of human error and delays.

- Tokenization of assets. Blockchain allows for the tokenization of assets, enabling fractional ownership of traditionally illiquid assets like real estate or art, making them more accessible and easier to trade.

- Enhanced cross-border payments. Blockchain streamlines cross-border payments by eliminating intermediaries, reducing transaction fees, and speeding up the process from days to minutes.

- Fraud prevention and security. The technology’s inherent security features make fraud prevention more effective, providing a tamper-proof system for recording transactions and verifying identities.

- Improved auditing and compliance. Blockchain provides a transparent and immutable record of financial transactions, simplifying auditing processes and ensuring compliance with regulatory requirements.

- Innovations in trading. Blockchain is reshaping financial markets by enabling peer-to-peer lending and decentralized trading platforms, reducing the need for traditional exchanges and brokers.

- Identity verification. Blockchain is used for identity verification, ensuring that personal and financial data is secure and reducing the risk of identity theft and fraud.

Blockchain Use Cases in Financial Services

Blockchain technology rapidly expands its footprint in the financial services industry, offering innovative solutions to longstanding challenges. From reducing costs and increasing transaction speed to enhancing security and transparency, blockchain's potential applications are vast and varied. Let's take a look at the most effective use cases for blockchain in financial services today:

- Cross-border payments. Blockchain technology is revolutionizing cross-border payments by reducing transaction times and costs. Traditional cross-border transactions often take several days to clear and involve high fees due to multiple intermediaries. Blockchain simplifies this process by enabling direct transfers between parties, reducing the time to just minutes and cutting costs significantly.

- Trade finance. Blockchain is streamlining trade finance by providing a transparent and secure platform for recording transactions, managing documentation, and verifying the authenticity of trade-related data. This reduces the risk of fraud and errors while speeding up the trade settlement process.

- Asset management. In asset management, blockchain allows for the tokenization of assets, enabling fractional ownership and easier trading of assets like real estate, stocks, and commodities. This democratizes access to investment opportunities and increases market liquidity.

- Supply chain finance. Blockchain is enhancing supply chain finance by providing a transparent, end-to-end view of transactions across the supply chain. This ensures that all parties involved, from suppliers to financial institutions, have access to accurate and timely information, reducing delays and the risk of fraud.

- Peer-to-peer lending. Blockchain is used for peer-to-peer lending by enabling direct lending and borrowing between individuals without the need for traditional financial intermediaries. This lowers costs and expands access to credit for those who traditional financial institutions might underserved.

- Identity verification. Blockchain is transforming identity verification processes by creating secure, immutable digital identities. Financial institutions can use these blockchain-based identities to quickly and securely verify customer information, reducing the risk of identity theft and fraud.

- Insurance claims processing. In the insurance sector, blockchain is used to automate and streamline claims processing. Smart contracts can automatically trigger claims payouts when specific conditions are met, reducing processing times and improving customer satisfaction.

- Fraud detection and prevention. Blockchain's immutable ledger is a powerful tool for fraud detection and prevention. By ensuring that financial transactions are recorded transparently and cannot be altered, blockchain reduces the opportunities for fraudulent activities and enhances the overall security of financial systems.

- Regulatory compliance. Financial institutions are leveraging blockchain to improve regulatory compliance. Blockchain's transparent and immutable records make it easier to track transactions, conduct audits, and ensure that all activities comply with relevant regulations.

- Digital identity management. Blockchain facilitates digital identity management, providing a secure way for users to manage and control their personal information. Financial services companies can leverage this to enhance customer onboarding processes, streamline KYC (Know Your Customer) procedures, and reduce identity-related fraud.

Let's look at some of the most popular areas where blockchain has a strong impact.

Blockchain Payment Processing

In the realm of payments, blockchain is proving to be a game-changer. The crypto payments market is expected to grow significantly, driven by the increased adoption of digital currencies. Blockchain-based payment systems offer lower transaction fees, faster processing times, and enhanced security compared to traditional methods. This growth is supported by research predicting the market's expansion from $1.29 billion in 2023 to $4.85 billion by 2033.

Blockchain Trading

Blockchain in financial markets is revolutionizing trading by providing more transparent and efficient ways to buy and sell assets. Peer-to-peer lending with blockchain is becoming more common, allowing individuals to lend and borrow without intermediaries. Additionally, the tokenization of assets allows for fractional ownership, making it easier to trade in traditionally illiquid assets like real estate.

Blockchain in Insurance

The global blockchain in the insurance market is poised for explosive growth, with projections showing an increase from $766 million in 2022 to over $33 billion by 2030. Blockchain for fraud prevention is a significant driver of this growth, as the technology enables the creation of tamper-proof records. Insurance companies also use blockchain to streamline claims processing, reduce fraud, and improve customer satisfaction.

Blockchain Loyalty and Rewards Programs

Blockchain loyalty and rewards programs are another exciting application. By leveraging blockchain for auditing, companies can ensure the accuracy and transparency of loyalty points and rewards. This reduces the potential for fraud and allows customers to track their rewards in real time. Moreover, blockchain enables the creation of more flexible and personalized loyalty programs.

What is the Future of Blockchain in Finance?

The future of blockchain in finance looks promising, with the market expected to reach $80 billion by 2032, growing at a CAGR of nearly 29%. Decentralized finance (DeFi) will significantly reshape traditional financial services, offering more accessible and inclusive options. As smart contracts evolve, they will enable more complex and automated financial transactions, reducing costs and increasing efficiency.

Blockchain's integration with technologies like AI and IoT will open up new possibilities, such as AI-driven investment strategies and real-time asset tracking. Meanwhile, regulatory frameworks are gradually adapting to accommodate blockchain, which will foster greater confidence and adoption within the financial sector.

FAQ

Do banks use blockchain?

Yes, many banks are exploring and implementing blockchain in financial services to enhance security, reduce costs, and improve transaction speeds. Major institutions are also involved in pilot projects to understand how blockchain in finance can be integrated into their existing systems.

What is fintech?

Fintech, short for financial technology, refers to integrating technology into financial services to improve and automate processes. It encompasses various applications, including mobile banking, online payments, robo-advisors, and decentralized finance (DeFi) platforms. Fintech aims to make financial services more accessible, efficient, and user-friendly, often reducing the need for traditional intermediaries. By leveraging technologies like blockchain, artificial intelligence, and big data, fintech companies are transforming how individuals and businesses manage their financial activities, making them faster, more secure, and often more affordable.

What is blockchain?

Blockchain is a type of distributed ledger technology that records transactions across multiple computers to ensure security, transparency, and immutability. It is the underlying technology behind cryptocurrencies and has many applications in financial transparency and beyond.

Comments (0)

Latest Posts

Learn how to build an online casino that scales: games, payment options, compliance basics, risk controls, and operational automation for growth.

Discover how automated AI call centers reduce operational costs, improve customer experience, and increase revenue. Learn about ROI, real statistics, integrations, and scalable AI solutions for modern businesses.

Do You Have any Questions?

Leave your details - we will contact you to answer all your questions