P2P Crypto Exchange Development: How to Create a Secure and Profitable Platform for Crypto Trading

Introduction

P2P cryptocurrency exchanges are becoming a key element of the modern Web3 economy. Users choose direct transactions, the absence of intermediaries, and low fees, while businesses gain the opportunity to launch a scalable trading platform with a global audience. This is why the development of a P2P cryptocurrency exchange has become a strategic direction for crypto projects and fintech companies.

What Is a P2P Cryptocurrency Exchange and Why It Is in Demand

A P2P cryptocurrency exchange is a trading platform where users buy and sell cryptocurrency directly from each other without the involvement of a bank or centralized exchange. The platform acts as a guarantor of the transaction: it locks assets in an escrow smart contract and protects both parties until the exchange is completed.

Why it is in demand today:

-

Users gain freedom: they can buy and sell cryptocurrency in any country and with any payment method.

-

Fees are lower than on centralized exchanges because there are no intermediaries.

-

Transactions are faster, and the rules are formed by market participants rather than the exchange.

-

The platform remains resistant to blocks and restrictions because it does not store funds and does not control financial operations.

This model makes P2P cryptocurrency exchanges an ideal choice for the global crypto community and an attractive business tool for Web3 project owners.

What Tasks P2P Crypto Exchange Development Solves

Creating your own P2P cryptocurrency exchange gives a business a powerful tool for scaling and entering the global market of crypto operations. Such a product allows a company to operate without intermediaries, minimize operational costs, and provide users with flexible and secure ways to exchange cryptocurrency worldwide.

The business gains control over the infrastructure, commission economy, and user experience, while users receive freedom of payment methods, fast transactions, and enhanced protection.

As a result, P2P cryptocurrency exchange development solves several key tasks:

-

Reducing dependence on centralized exchanges and full independence from their policies and restrictions.

-

Increasing company revenue through commissions, premium features, escrow, advertising, and additional services.

-

Creating a global platform accessible to users from different countries regardless of banking restrictions.

-

Enhancing transaction security with escrow mechanics, KYC/AML, and anti-fraud protection.

-

Forming a complete ecosystem that includes a P2P marketplace, wallets, referral programs, and internal tokens.

This solution helps companies launch a sustainable crypto product with high monetization and stable growth.

How a P2P Crypto Exchange Generates Profit for the Business

A properly developed P2P cryptocurrency exchange becomes a stable source of income thanks to multiple built-in monetization mechanisms. Unlike centralized exchanges, the business gains full control over commissions, user access, and the ecosystem, which allows flexible revenue management and rapid product scaling.

Main revenue channels:

- Transaction fees. The exchange receives a percentage of each trade or a fixed fee. Even with low rates, high turnover creates stable income.

- Escrow fees. Additional revenue for holding assets in secure smart contracts and providing protection for both parties.

- Order placement fees. Users can pay to highlight their listings or increase visibility in search results.

- Premium features. Accelerated verification, higher limits, early withdrawals, enhanced tools for large traders.

- Referral programs. Attracting new users reduces marketing costs and increases trading volume.

- Fiat and payment integrations. Fees for additional payment methods, merchants, and card verification.

- Native token. Launching a token enables monetization of the audience through utility mechanics, staking, reduced fees, and liquidity.

- Advertising and partner programs. The platform can monetize traffic through banners, DeFi offers, or partner promotions.

Key Features of a Competitive P2P Cryptocurrency Exchange

- User account dashboard;

- Escrow mechanism for transactions;

- Filters and smart search for listings;

- Built-in crypto wallets and multi-currency support;

- KYC/AML module;

- Rating system for buyers and sellers;

- Admin panel for economic management;

- Support for Web3 wallets (MetaMask, WalletConnect);

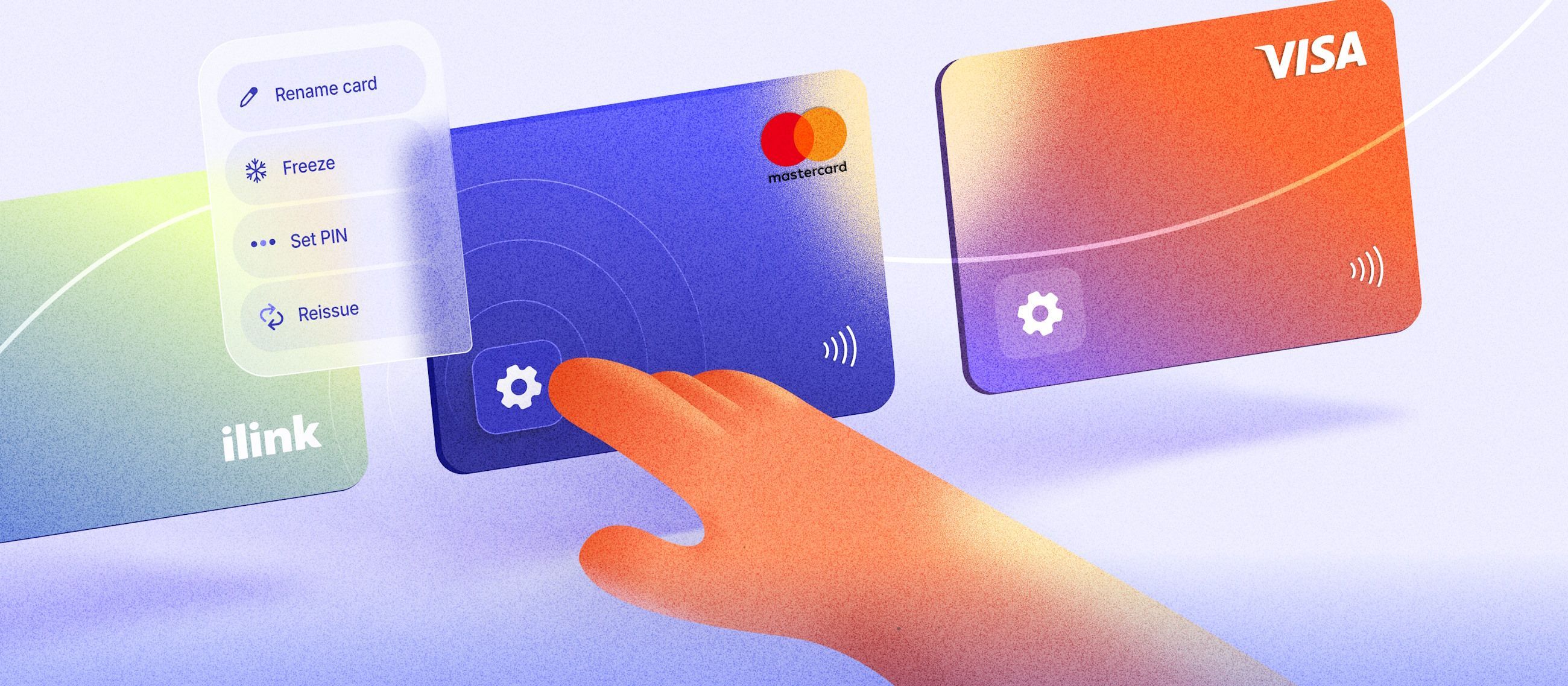

- Support for bank cards and other payment methods;

- Integration with blockchains and nodes.

Stages of P2P Cryptocurrency Exchange Development

- Requirement analysis and tokenomics design;

- Architecture and smart contract development;

- Interface implementation and trading logic;

- Integration of payments, wallets, KYC;

- Security audit;

- Load testing;

- Deployment and technical support.

How Much P2P Cryptocurrency Exchange Development Costs

The cost always depends on the number of features, security level, and integrations.

Approximate ranges:

- Basic platform: from $25,000;

- Medium complexity: $45,000–$80,000;

- Enterprise level / multichain: from $100,000.

Why ilink Is Chosen as a Developer of Cryptocurrency Solutions

The company ilink is an experienced professional in developing P2P cryptocurrency exchanges. We create a reliable ecosystem where security, liquidity, and convenience work together as a unified system.

- 13+ years of developing high-load systems.

- Expertise in Web3, DeFi, and smart contracts.

- Team of architects, backend developers, and blockchain engineers.

- Wallet, node, and payment gateway integrations.

- High security and audit standards.

- Fast development start and transparent processes.

Comments (0)

Latest Posts

The sustainability of a token’s economy determines liquidity, user activity, long-term growth potential, and the ability of a project to survive without constant capital injections.

A White Label solution allows businesses to get a ready-to-use banking platform under their own brand in 60–90 days, including fiat accounts, cards, cryptocurrency modules, KYC/AML, a mobile application, and administrative panels.

Ready to Launch a P2P Cryptocurrency Exchange?

Submit a request and get an accurate development estimate and timeline.