White Label Neobank: How to Launch a Digital Bank in 90 Days

Introduction

In 2025, the digital banking market is growing faster than ever. Users are shifting to mobile payments, cryptocurrency operations, and multi-currency wallets, and no longer want to depend on outdated banking systems. This is why a White Label Neobank has become the fastest way to launch your own digital bank without years of development, complex licensing, or expensive infrastructure.

A White Label solution allows businesses to get a ready-to-use banking platform under their own brand in 60–90 days, including fiat accounts, cards, cryptocurrency modules, KYC/AML, a mobile application, and administrative panels.

What is SaaS and What is White Label

SaaS is a software model where a company uses a ready-made product on a subscription basis, without having to develop and maintain it on its own.

White Label is a product that fully belongs to a business in terms of branding. The client receives a ready digital banking platform, adjusts it to their colors, logos, tariffs, and launches it on the market as their own solution.

A White Label Neobank combines both models: ready banking infrastructure (SaaS) + individual branding and functionality (White Label).

How a Neobank Works

A neobank is like a traditional bank, but fully digital and without physical branches. A neobank serves customers through a mobile application or web platform. It operates on a modular system, where each function is a separate component:

-

Fiat accounts;

-

Cryptocurrency accounts;

-

Banking cards;

-

Payment gateways;

-

KYC/AML;

-

Smart contracts;

-

Analytics;

-

Admin panels;

-

Mobile application.

A White Label Neobank solution unifies all these modules into one ecosystem, allowing businesses to launch a digital bank without long development cycles.

Why White Label Neobank Is Beneficial for Businesses

A White Label solution gives companies a fast, scalable, and cost-effective way to enter the financial services market with a ready-made product that only requires branding and configuration.

Businesses gain:

-

Fast launch in 90 days. No need to build infrastructure, architecture, KYC, or payment modules, everything is ready.

-

Minimal investment. Developing a neobank from scratch starts at $300k–$1M. A White Label solution is 5–10 times cheaper.

-

Full control over brand and product. The company manages tariffs, commissions, user groups, cards, accounts, and monetization.

-

Hybrid fiat and crypto functionality. Businesses can serve both Web2 and Web3 audiences.

-

Global market reach. Multi-currency accounts, crypto services, and digital identity enable worldwide operations.

A White Label Neobank is a fast path to launching a fintech project with reliable and scalable growth.

What Tasks a White Label Neobank Solves

A White Label solution enables:

- Launching a neobank under your own brand;

- Introducing multi-currency and cryptocurrency accounts;

- Issuing banking cards and mobile applications;

- Managing clients, tariffs, and limits;

- Securing financial operations;

- Creating a hybrid Web2/Web3 financial product;

- Entering the market quickly without backend development or infrastructure.

Key Features of a Neobank

A ready-made Neobank includes a full set of modules needed to launch a modern digital bank under your brand. All features operate within a secure ecosystem that can be scaled and customized to your business needs.

1. Multi-currency Accounts and Payments

- Support for fiat currencies;

- Deposits, withdrawals, and internal transfers;

- Integrations for international payments;

- Balance management and transaction history.

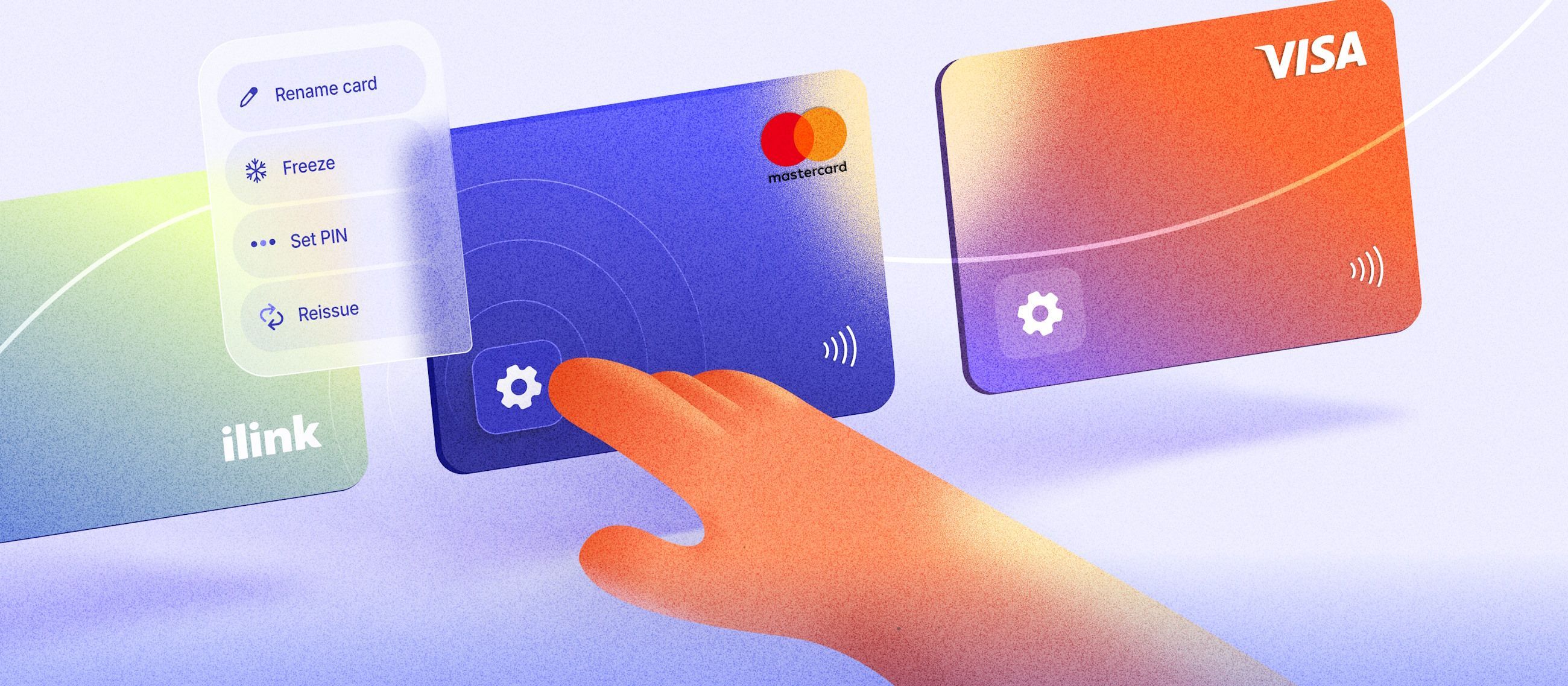

2. Banking Cards (Virtual and Physical)

- Card issuance and management;

- Limits, commissions, and settings;

- Secure processing of online and offline payments.

3. KYC/AML and Risk Management

- Automated client verification;

- Application and status management;

- Compliance tools for regulatory requirements.

4. Administrative Panel

- User and account management;

- Tariff, limit, and commission configuration;

- Financial analytics and monitoring.

5. Mobile Application under Your Brand

- Fully customizable UI/UX;

- Personal dashboard, payments, transfers;

- Notifications, security, and smooth client experience.

6. Cryptocurrency Integration (optional)

- Cryptocurrency wallet functionality;

- Deposits, withdrawals, exchange;

- Secure storage or non-custodial approach.

7. Payment Gateway and API for Business

- Ability to accept payments;

- Invoice generation;

- Integration of banking and crypto operations through API.

8. Extended Product Management Tools

- Tariff plan configuration;

- Commission management;

- Dynamic exchange rates and customizable parameters.

How a Neobank Launch Works with the White Label Model

- Analysis of the business model and requirements;

- Module configuration (fiat, crypto, cards);

- Integrations (banks, providers, KYC, liquidity);

- Branding of UI/UX and the mobile application;

- Backend and admin panel setup;

- Testing and security audits;

- Launch of the neobank under your brand;

- Technical support and scaling.

Why Choose the White Label Neobank by ilink

ilink is a trusted technology partner with 13 years of experience, specializing in digital banking, crypto modules, and Web3 fintech solutions. ilink enables fast, secure, and cost-efficient digital bank launches.

The company provides:

- Ready fiat and crypto modules under your brand;

- Architecture designed for high load systems;

- Integrations with banking APIs, crypto systems, and card providers;

- Enterprise-level security infrastructure;

- Post-launch support;

- Customization of functionality for your business model.

Comments (0)

Latest Posts

The sustainability of a token’s economy determines liquidity, user activity, long-term growth potential, and the ability of a project to survive without constant capital injections.

Staking platforms allow projects to attract liquidity, increase TVL, and strengthen tokenomics.

Need a digital banking platform under your brand?

Request a consultation.